In a time where we’re undergoing financial instability, it makes sense, more than ever, to consider your money management: how to keep track of your expenses and achieve financial stability. Tracking your expenses on a monthly basis is one of the best ways to stay on top of your financial obligations, avoid unexpected bumps in the road, and go on to achieve your financial goals – maybe leaving enough left over for the odd treat. Keeping a close eye on your spending habits will enable you to make informed decisions, allocate funds effectively, and navigate the complex financial landscape out there – with all the different products, services, and advice on offer.

This blog post will, as an overview, cover how to track expenses and save money. But, delving a little deeper, it’ll cover the multiple benefits of monthly expense tracking, specific methods you can use when tracking your monthly spending, and how this practice can have a positive impact on your financial wellbeing, help improve your financial literacy, and possibly even improve your credit score.

What are expenses?

To know how to keep track of your expenses, you need to know what they are

Monthly expenses can cover a whole range of things, depending on your circumstances; for example whether you own a car, or if you have children or not. These expenses, whether for individuals or families, cover a range of essentials that are pretty much unavoidable when it comes to daily living. For a typical person, they include:

| Expenses | Description |

|---|---|

| Housing Costs | Rent or mortgage payments for your accommodation |

| Utility Bills | Gas, electricity, water bills etc. |

| Transport Costs | Train/bus fares or fuel expenses for your car |

| Insurance Costs | Car, pet, home, and life insurance |

| Food | Weekly grocery expenses |

| Occasional Meals Out | Costs associated with dining out occasionally |

| Communication Costs | Mobile phone, landline, and internet service charges |

| Childcare Costs | Expenditures for childcare services and facilities |

| Education Expenses | Costs for school uniform, shoes, stationery |

| Entertainment Expenses | Expenditures on entertainment, particularly if you have young children |

| Outstanding Debts | Personal loans, credit cards, or car payments |

| Contingency Budget | A little extra, just in case an emergency crops up |

Why should you bother to track your monthly spending?

Getting down to the nitty gritty, it’s actually quite tough tracking your monthly spending – keeping an eye on all your incomings and outgoings, down to the last penny. But it’s essential if you want to steer clear of money worries and even leave something aside for little luxuries here and there. So, while it might seem complex – a bit of a mathematical conundrum – here are the benefits of tracking monthly expenses…

Precise budgeting: the varying regional costs of living, across the US, means meticulous financial planning is a must. Tracking your monthly expenses, enables you to create a finely-tuned budget that aligns with your income, your financial aspirations, and the area in which you live.

Increased awareness of your spending: monitoring your expenses on a monthly basis automatically makes you more aware of your financial behavior.

It allows you to view what’s necessary and what, perhaps, is unnecessary, in terms of where your money is going. This awareness is essential in identifying areas where you can trim your spending and direct your financial resources towards more meaningful pursuits and goals.

Carefully planned debt management: with a number of financial products and services on the market, you may well be tied into several credit agreements, such as loans and credit card payments. Knowing how to keep track of your monthly expenses enables you to strategically manage your debts, directing your payments towards high-interest obligations and, ultimately, reducing those debts over a shorter period of time. If things are tight, it’s also possible to negotiate with your lenders. For example, you may qualify for a ‘mortgage holiday’ if you’re struggling with making payments.

Savings and investments: Once you have a comprehensive understanding of your monthly expenditure, you can put a certain proportion of your wages towards savings and investments, allowing you to achieve particular financial goals. It might be worth considering the 50-30-20 rule, where 50% of your money goes towards your needs (absolute essentials), 30% goes towards your wants (things you desire, or little treats), and 20% goes towards savings. By adopting this approach, you may be able to save for something like a once-in-a-lifetime holiday, refurbishment of your home, or look at financial products, like an Individual Retirement Arrangement (IRA).

Being prepared: you never know when the unexpected might happen – which is why it’s called the unexpected! It may be that your beloved pet has to have expensive treatment at the vet, your car requires costly repair work, or monthly bills (maybe energy) are higher than expected. It’s always best to be prepared with some ‘emergency funds’, and you’ll only know if these funds are available (and how much is available) if you’ve been diligently tracking your monthly expenses.

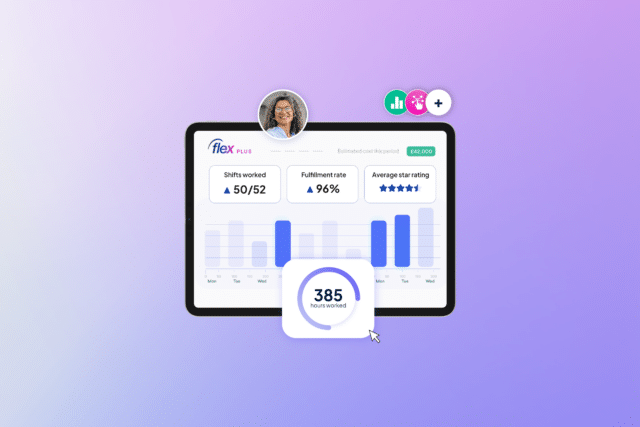

At Indeed Flex, we’re aware that sometimes ‘things happen’, which is why we launched our Same Day Pay service, to enable you to access your wages almost immediately after you’ve finished work.

Improving financial literacy: by staying on top of your money and budgeting sensibly, you become more aware of the financial world around you and all of the associated terms. You’ll come to understand basic financial concepts much better, such as interest rates, inflation, compound interest and what they all mean for you – how they affect your daily life.

Reducing your stress levels: last but not least, expense tracking will ease your stress levels when it comes to all things financial. Knowing exactly what you’ve got coming in, what you’ve got going out, and what’s left over, will take some of the pressure off you – knowing all of the essentials are covered each month.

How to track your monthly expenses

Tracking your expenses needn’t be, well… expensive

There are numerous ways you can choose to track your expenses – numerous different methods you can use – and they’re all free. So, take a look at the list we’ve compiled below and see which ones you’d use on a regular basis.

Use digital banking platforms: long gone are the days of bricks and mortar banks, with branches you could just walk into and speak to your bank manager (well they still exist, but there aren’t nearly as many as there were). There are now dozens of banks offering online-only platforms – and nearly all of them will automatically categorize your transactions, giving you a much clearer view of your monthly spending. Consistently reviewing your digital bank statements, and the categories your monthly payments fall into, gives you a far more organized overview of your monthly expenses, and what is/isn’t necessary.

Take advantage of expense tracking apps: just a side-step from digital banking really, but there are, again, dozens of apps that help to track your expenses. A quick Google search turns up a variety of great apps that seamlessly sync with your bank accounts and credit cards, categorizing your transactions and offering real-time insights into the state of your financial health.

Set up a good, old-fashioned spreadsheet: utilize software such as Microsoft Excel or Google Sheets to create personalized expense tracking spreadsheets. Tailor these spreadsheets to include categories such as those mentioned earlier in this post: transportation costs, utility bills, insurances, food, and so on. Recording all your income and expenses in this way will really help you to get an idea of exactly where your money is going, and identify areas where you can cut back.

Use a budget template: A budget template can help you to stay organized and make budgeting that much easier. There are many free templates available online, such as this one, from Money Saving Expert, or you can create your own. A budget template should include all of your income sources, expenses, and savings goals.

Use an old method – cash envelopes: This is a quick and simple way of tracking your expenses and sticking to your monthly budget. Just put physical cash into envelopes designated for categories such as food, bills, entertainment, and eating out, and don’t spend any more than you’ve got in each envelope.

Use an even older method – receipt tracking: if you prefer offline methods of tracking your expenses, then keep hold of your receipts and manually input your expenses at the end of each day or week – maybe write them down in a notebook. This offers a tangible, visual way of keeping tabs on your money.

Regularly review your budget: review your budget on a regular basis, to ensure you’re staying on track. Make adjustments as necessary, and don’t be too hard on yourself if you slip up. Budgeting is a learning process, and it takes time to get it right.

Take advantage of discounts: this isn’t so much a tip for tracking your expenses, but it may well help to free up some of your budget for other things across the month.

Tracking your monthly expenses – in summary

Monthly expense tracking is something that takes time and patience, but will ultimately allow you to take control of your finances, make calculated (literally) decisions, and proactively work towards your financial goals. Regardless of your chosen tracking method – whether digital, app-based, spreadsheet-driven, or good old-fashioned pen and paper – it’s vital to be consistent in your approach and maintain discipline.

By analyzing your monthly spending patterns and fine-tuning your budget in response, you can ease your money worries and even experience a degree of financial freedom. Try some of the steps outlined in this post for a month and see how you fare. You may find that tracking your expenses in this way brings you that little step closer to securing a brighter financial future and the rewards that come with that.

Download Indeed Flex App today and benefit from the freedom to choose when you get paid, to help you nail your money management.