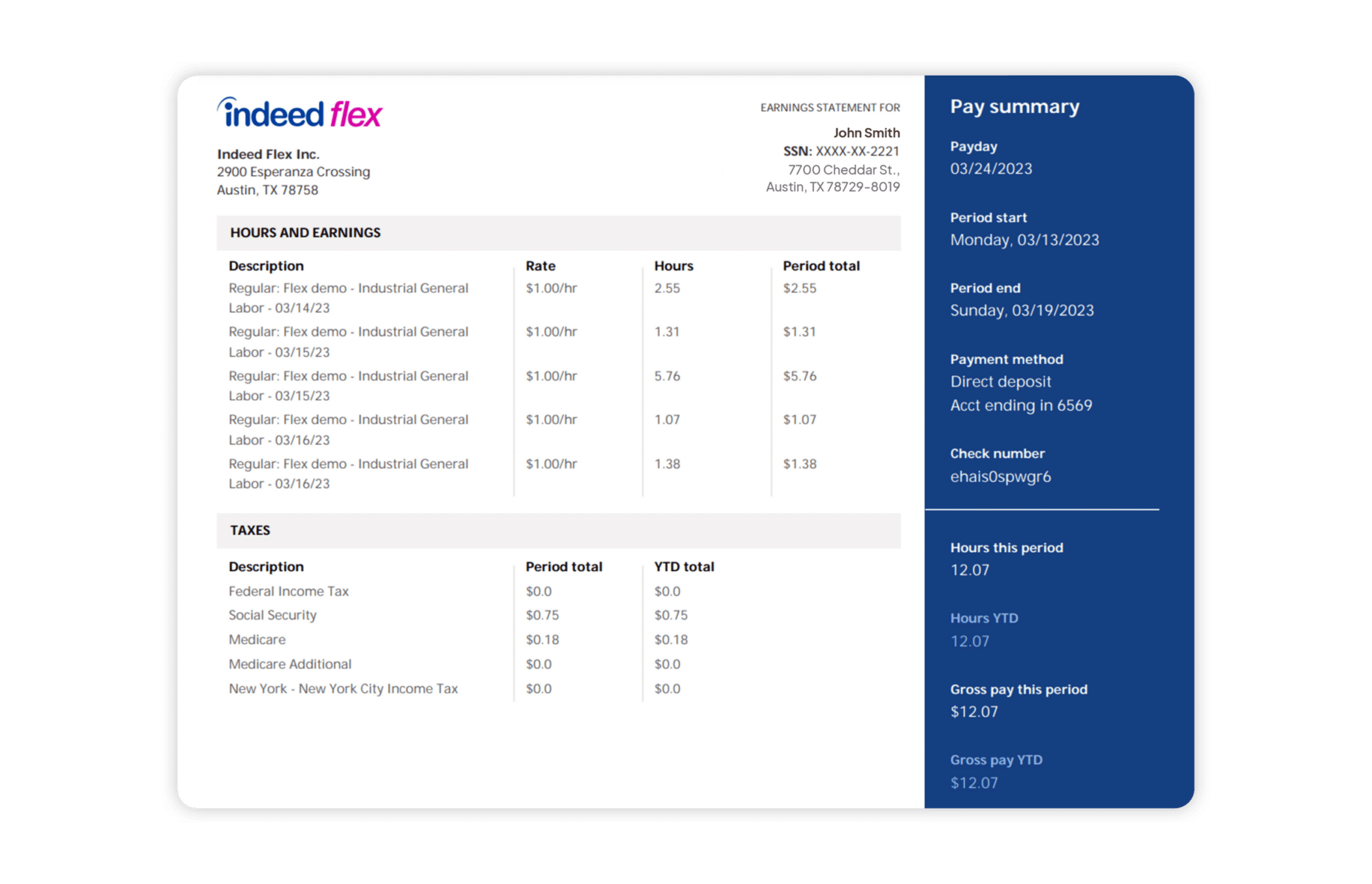

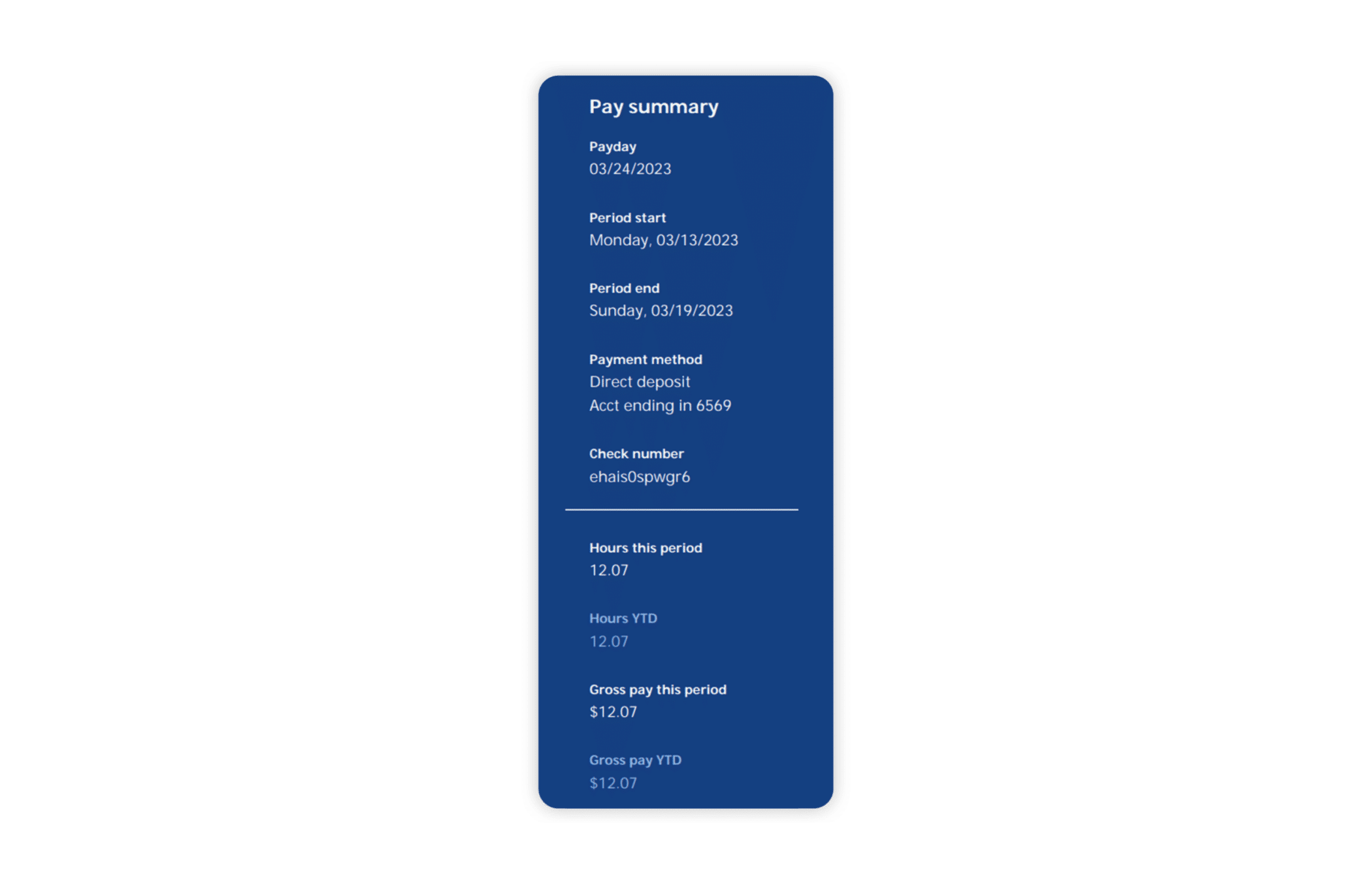

What is a pay stub?

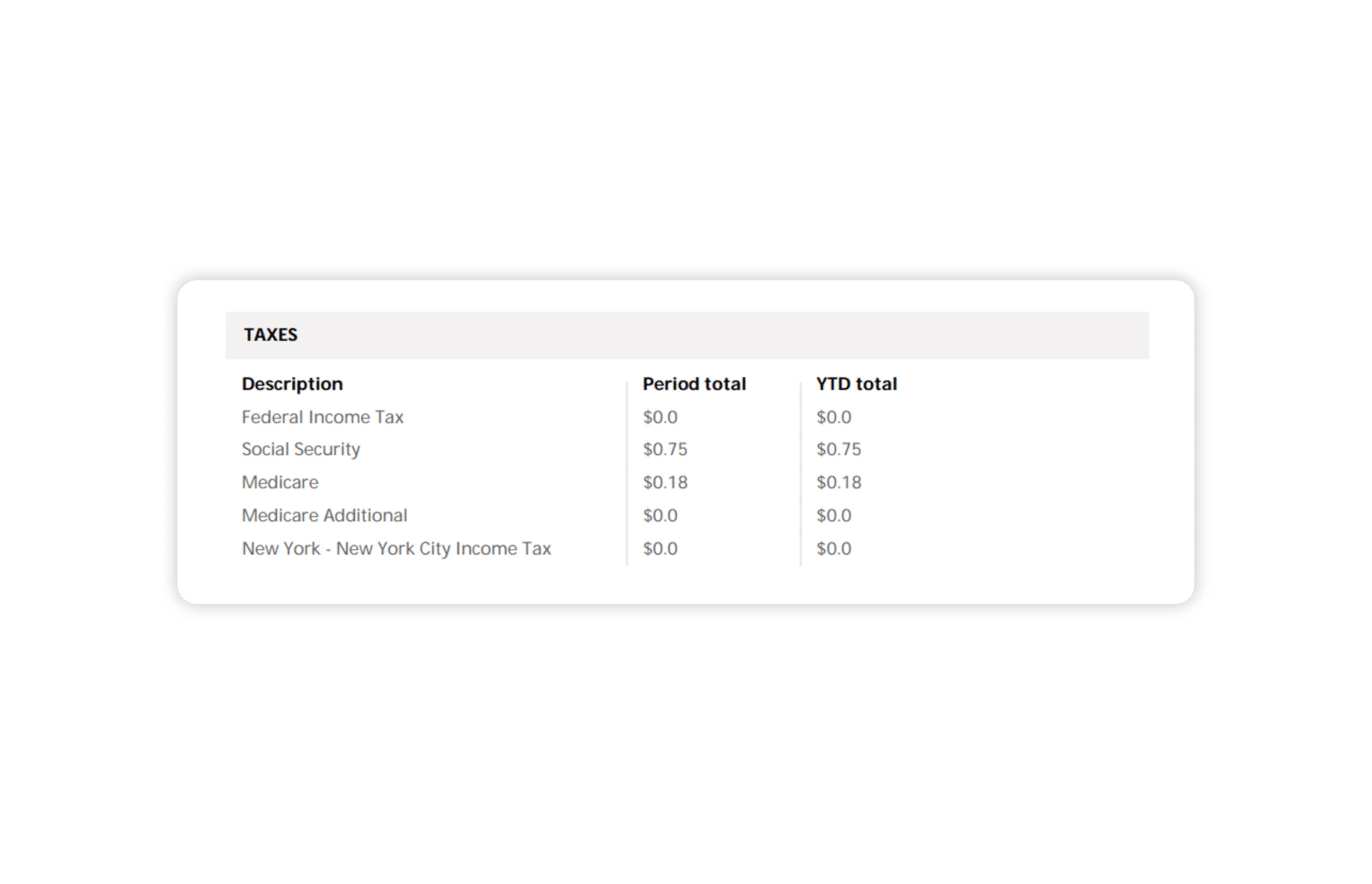

A pay stub is a record of the wages you received, the taxes collected during that pay period, and your gross pay and net pay. Mandatory deductions include federal and statutory deductions where applicable, FICA taxes, and wage garnishments. FICA taxes, which are part of the Federal Insurance Contributions Act, include Social Security and Medicare taxes. Your pay stub might also include information about pre and post-tax deductions.

Pre-tax deductions

Pre-tax deductions are taken out of your paycheck before taxes are calculated. These can include medical and dental benefits, 401K retirement plans (which can reduce federal and most state income taxes), and group-term life insurance.

Post-tax deductions

Post-tax deductions are taken out of your paycheck after taxes are calculated. These can include wage garnishments and Roth IRA retirement plans.

Gross pay and net pay

Your gross pay is the total amount of wages you’ve earned for the pay period, which includes your regular pay plus any additional wages like overtime pay or bonuses. Your taxes are calculated based on your gross pay.

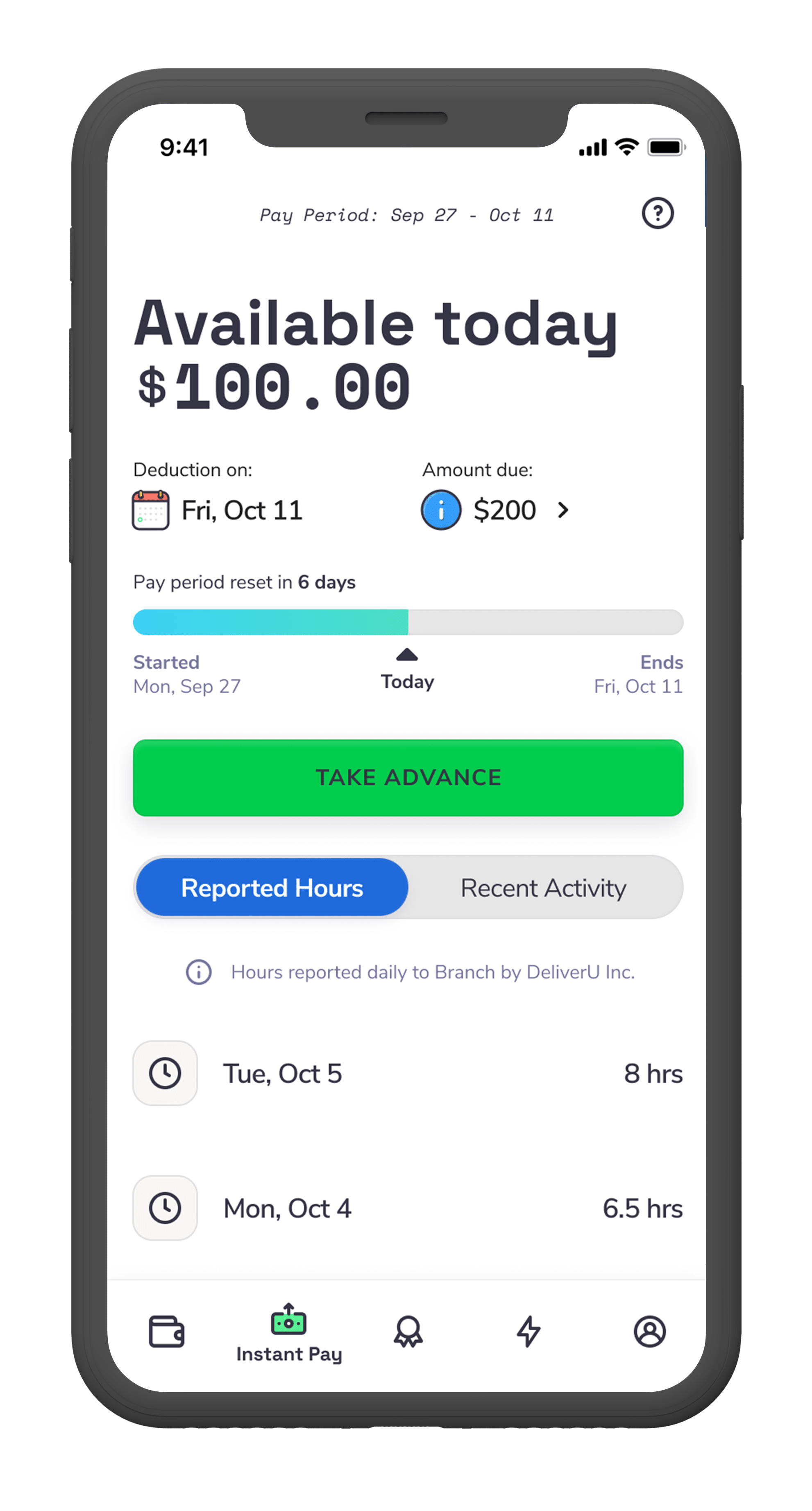

What is Same Day Pay?

Same Day Pay allows you a pay advance of up to 50% as soon as an hour after you’ve completed your shift using Branch. Branch is a digital banking app that is free to use. It is optional, which means that you can choose whether or not you want to use it.

Paid time off and vacation

Indeed Flex does not provide paid time off unless required by state regulations or the client. You will be notified if an assignment you work is eligible for any types of time off, including paid sick leave, vacation or holiday pay.

A bit more detail

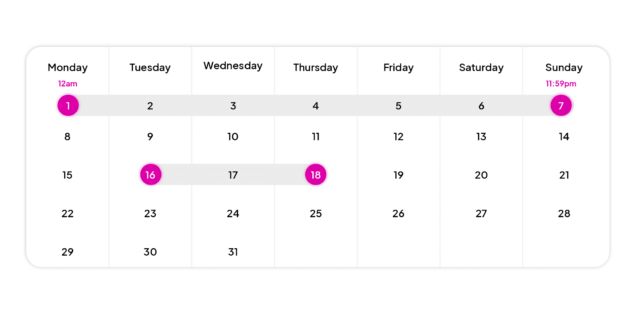

Payroll Schedule

Same Day Pay

401 (k)

Forms

Tax